Normal Paraffin Supplier

N- Paraffin Description, Normal Paraffin Supplier From Dubai and Turkey

Normal Paraffin is a clear liquid that are made up of saturated hydrocarbons with a straight-chain structure. They are either extracted from kerosene or through the “Fischer-Tropsch process” at gas-to-liquid production sites. Paraffin (or called kerosene) is a mixture of hydrocarbons; it usually consists of about 10 different hydrocarbons, each containing from 10 to 16 carbon atoms per molecule; the constituents include n-dodecane, alkyl benzene, and naphthalene and its derivatives. Kerosene is obtained from crude oil by distillation and is used as a fuel for heating and aircraft. N-paraffin C10-C13 is a colorless liquid with a mild odor. It is insoluble in water. It is slow-evaporating, environmentally adapted (fully bio-degradable) with negligible sooting (like lamp oil).

Normal Paraffin is the major raw material for the manufacture of the LAB. Normal Paraffin is extracted from kerosene which contains an average of 20/25% paraffin and therefore is generally produced close to a refinery as the kerosene, free of the paraffin removed has to be returned to the refinery. Over 80% of Normal Paraffin is used for the production of the LAB the remaining N-Paraffin may be further processed to obtain special solvents used for various industrial applications including synthetic resins, paints and varnishes, degreasing agents and printing inks. Normal paraffin operates as a dissolver in industrial for producing polymers and resins, colors, artistic coverings and grease polisher.

N-Paraffin and ISO Paraffin

Paraffins can be arranged either in straight chains (normal paraffin) or branched chains (isoparaffins). Most of the paraffin compounds in naturally occurring crude oils are normal paraffin, while isoparaffins are frequently produced in refinery processes. The normal paraffin are uniquely poor as motor fuels, while isoparaffins have good engine-combustion characteristics. Longer-chain paraffin are major constituents of waxes. Normal paraffin are produced from select kerosene and/or gasoil, feedstocks using molecular sieves extraction. After appropriate purification treatment of desulfurization, dearomatization, the n-paraffin stream is passed into the fractionation unit, then the desired carbon cuts are obtained. Normal paraffins are used as a solvent; a basic material in the manufacture of surfactants; in the manufacture of metalworking compounds, lube oil components, plasticizers and chloroparaffins; production of oils for aluminum cold rolling; catalyst carrier for olefin polimerization; raw materials for a wide range of applications.

Applications of Normal Paraffin

N-Paraffin is mainly used in the production of Linear Alkylbenzene (LAB) as well as in the manufacture of chlorinated paraffin wax, plasticizers, lamp oils, BBQ lighters, barbeque starters, sealant, adhesives, manufacture of alcohol derivatives, cutting oils, lubricants and metalworking products.

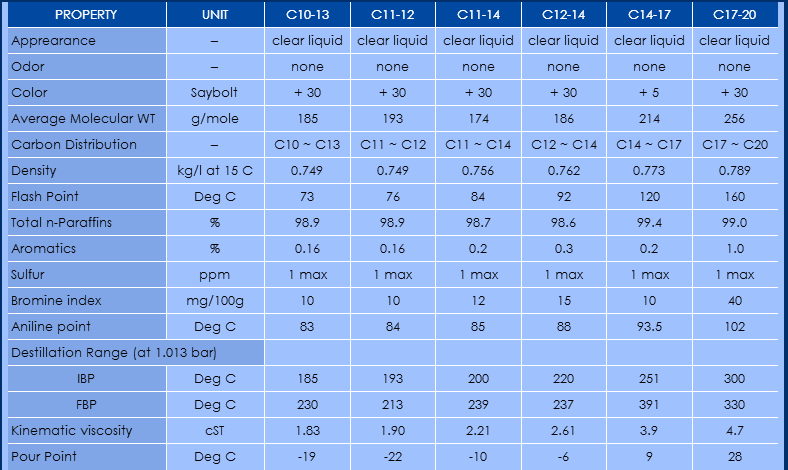

Physical and Chemical Properties

Normal Paraffin Price and Market Size

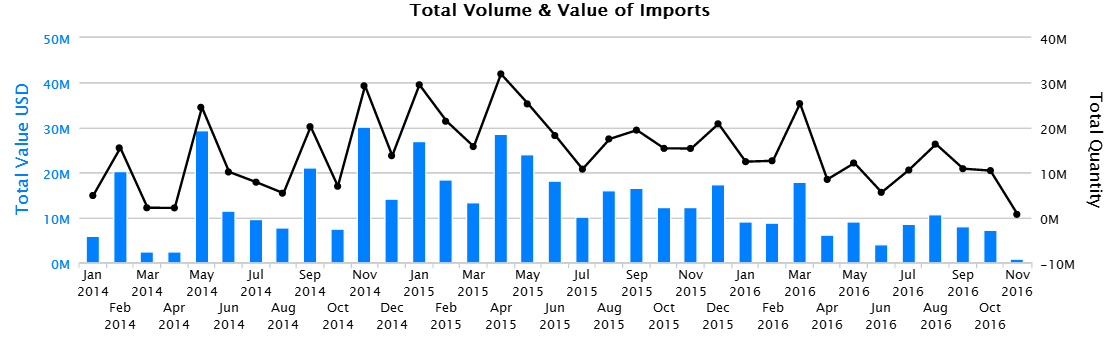

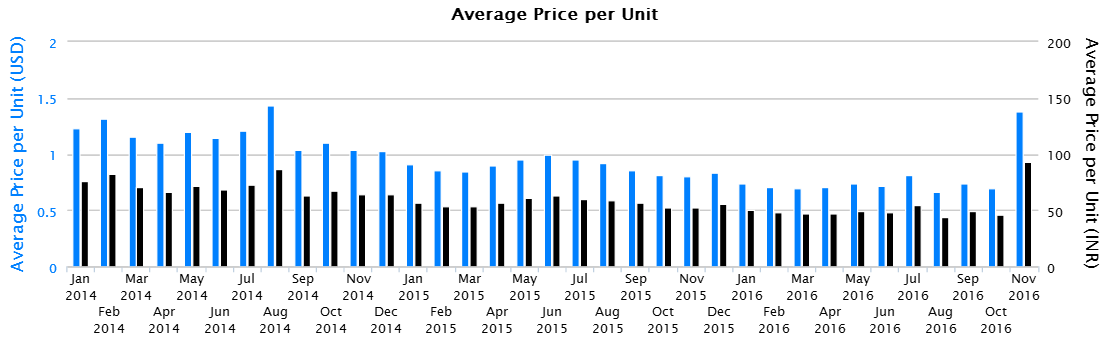

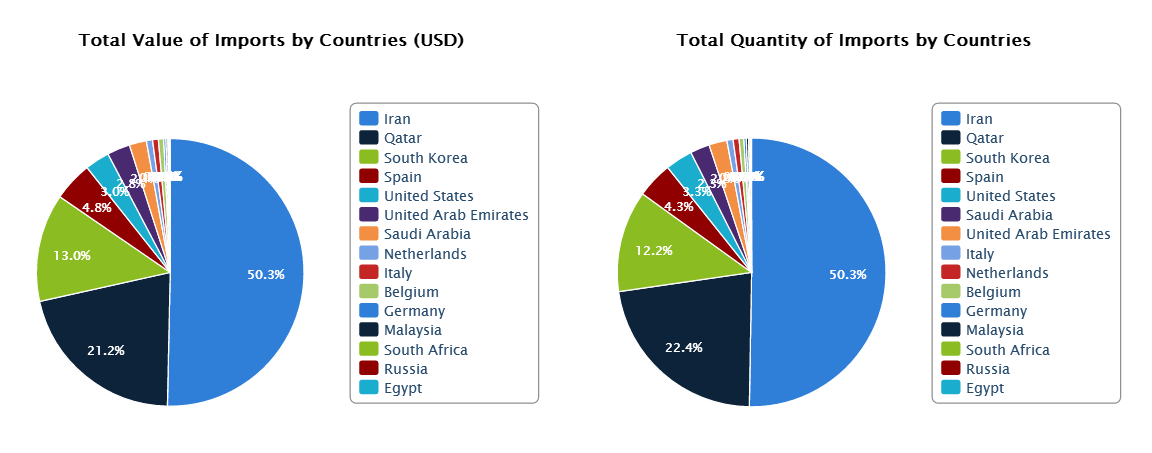

International statistics show that Iran is the largest exporter of normal paraffin to India by 2016. RAHA Paraffin Co is also one of the pioneer exporters in the petroleum products, especially normal paraffin. Our customers all over the world are satisfied with the perfect and reliable service of our company. Below is provided an analysis of the volume of imports and price of normal paraffin in India.

Global normal paraffin market revenue is poised to garner USD 20.8 billion by 2032 with a CAGR of 4.6% from 2024 to 2032

Asia-Pacific normal paraffin market value occupied around USD 6.1 billion in 2023

North America normal paraffin market growth will record a CAGR of 5.3% from 2024 to 2032

Among type, the C10-C13 sub-segment gathered utmost revenue in 2023

Based on grade, the industrial grade sub-segment occupied 46% market share in 2023

Liquid form occupied maximum revenue accounting for USD 8.2 billion in 2023

Increasing demand for sustainable and eco-friendly products is a popular normal paraffin market trend that fuels the industry demand

Global Normal Paraffin Market Dynamics

Market Drivers

- Growing demand for detergents and surfactants drives normal paraffin consumption in various industries

- Increasing use in the petrochemical industry enhances the market growth of normal paraffin

- Rising applications in pharmaceuticals and chemicals boost the demand for normal paraffin products

- Expansion of renewable energy sector creates new opportunities for bio-based normal paraffin products

Market Restraints

- Volatility in crude oil prices affects the stability and profitability of normal paraffin markets

- Environmental concerns over fossil fuel derivatives pose challenges to the normal paraffin industry

- Stringent regulatory policies limit the growth and expansion of the normal paraffin market

Market Opportunities

- Development of bio-based normal paraffins addresses environmental concerns and meets regulatory standards

- Innovations in sustainable production processes enhance efficiency and reduce the carbon footprint

- Expanding markets in emerging economies offer significant growth potential for normal paraffin products

Normal Paraffin Supplier Market Insights

Several main variables drive the normal paraffin market, resulting in its growth and expansion. One major driver is rising demand for detergents and surfactants, which are crucial components of household and industrial cleaning solutions. Normal paraffins, particularly linear alkylbenzene (LAB), are essential ingredients in the synthesis of these detergents. Rising global population, urbanization, and higher living standards have resulted in increased demand for cleaning products, driving the normal paraffin market. Furthermore, the growing petrochemical industry, which uses ordinary paraffins as feedstock for a variety of chemical processes, drives market expansion.

Despite these development drivers, the normal paraffin market confronts a number of challenges. Crude oil price volatility is a serious concern because typical paraffins are sourced from petroleum. Fluctuating oil prices might cause uncertain production costs and undermine market stability. Furthermore, environmental concerns about the use of fossil fuel derivatives impose another constraint. As worldwide awareness of environmental issues rises, industries face increased pressure to reduce their carbon footprint, potentially limiting the usage of traditional paraffins. Stringent regulatory rules aiming at reducing emissions and encouraging sustainability place additional demands on market participants, potentially resulting to higher compliance costs and operational limits.

However, these limitations create chances for innovation and expansion in the traditional paraffin sector. Bio-based normal paraffins, obtained from renewable sources such as biomass, are gaining popularity as a more sustainable alternative to standard paraffins. This shift toward environmentally friendly products is motivated by both governmental regulations and market desire for greener alternatives. Innovations in sustainable industrial techniques, which aim to reduce emissions and improve energy efficiency, are also opening up new markets. Furthermore, emerging countries have great potential, as increased industrialization and urbanization stimulate demand for standard paraffin-based products. Companies who can successfully negotiate these dynamics are well-positioned to capitalize on the changing market landscape.

Specification of N-Paraffin C10-C13

| PROPERTY | TEST METHOD | SPECIFICATION | TYPICAL VALUE |

| DENSITY at 15.6°C gr/cm³ | ASTM-4052-96 | 0.7490-0.7530 | 0.7506 |

| SAYBOLT COLOR | ASTM-156-00 | +29min | >+30 |

| BROMINE-INDEX, mg BR/100gr OF SAMPLE |

ASTM D-1492-87 | 20max | 7 |

| CARBON DISTRIBUTION, WT% NORMALIZED≤C9 C10-C13, C14 |

UOP915-92 | 0.2max

99min 0.7max |

—

99.65 0.35 |

| AVERAGE MOLECULAR WEIGHT | UOP915-92 | 163-169 | 166.3 |

| MOISTURE, PPM | UOP481-91 | 100max | 15 |

| TOTAL NORMAL PARAFFIN WT% | UOP915-92 | 98min | 99.11 |

| SULFUR, PPM | UOP727-72 | 2max | <1 |

| CHLORIDE, PPM | UOP395-90 | 1max | 0.1 |

| AROMATICS, WT% | UOP495-00 | 0.5max | 0.4 |

| PEROXIDE NUMBER | ASTM E-299-97 | 2max | 0.1 |

| NITROGEN, PPM | ASTM D-6366-99 | 1max | <0.5 |