Paraffin Wax Price

Global Paraffin Wax Price, Market - Analysis, Technologies & Forecasts to 2025

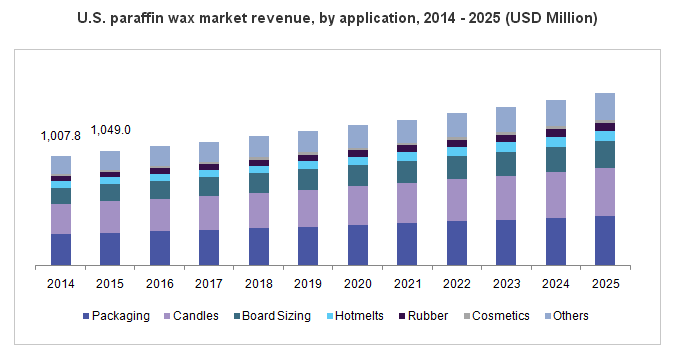

The global paraffin wax market size was valued at USD 4.87 billion in 2015. Growing application of the product for manufacturing candles along with its rising requirement in packaging and hotmelts is expected to stimulate the paraffin wax demand over the forecast period. Moreover, these products provide excellent water resistance to packaging materials and are anticipated to witness significant rise over the forecast period.

Paraffin waxes are used for manufacturing fragrance candles as they are economical and require lesser machinery costs. Growing demand for aromatherapy and consumer awareness regarding home ambiance is expected to drive the requirement of fragrance waxes, which in turn is likely to aid in market expansion over the upcoming years. In addition, rising consumption of chlorinated paraffin as a flame retardant and plasticizer in flexible PVC is likely to drive market growth over the next nine years. Increasing usage in the production of industrial coatings, hot melt adhesives, plastic & rubber processing aids, body care products, metal casting, pharmaceuticals, and electrical insulations is expected to drive demand in the near future.

Paraffin waxes are petroleum-sourced products, and therefore volatile petroleum prices along with harmful emissions are likely to restrain industry growth over the forecast period. Furthermore, the increasing usage of environment-friendly alternatives, such as beeswax, soy, and polyethylene wax, are expected to pose challenges for the product growth.

Regional Visions in Paraffin Wax Price

The Asia Pacific dominated the global market and accounted for 33.3% of the volume share in 2015. The region is expected to show high gains in light of growing personal care, packaging, rubber, and pharmaceuticals industries in China, India, and South Korea. Increasing need for hotmelt adhesives in countries including China, Taiwan, Australia, India, and South Korea for packaging and woodworking is anticipated to augment growth. China is one of the leading exporters of paraffin wax owing to the presence of large-scale companies including Sinopec and PetroChina. In addition, high investments by several Indian refineries including Chennai Petroleum Corporation Limited and Numaligarh Refinery Limited to expand their wax production capacities are expected to stimulate industry growth. North America is expected to witness rise on account of high demand for fragrance candles along with rapidly growing cosmetic, pharmaceuticals, and packaged food & beverage in the U.S. and Mexico. Hectic work schedules and wrong eating habits of consumers are likely to drive the demand for packaged food, which in turn is anticipated to fuel growth over the forecast period. High demand for cosmetics, fragrance products, and food packaging is likely to drive product demand in Middle East & Africa. Moreover, increasing oil & gas exploration in the region is likely to drive the availability of raw materials, which in turn is expected to propel growth over the forecast period.

The global paraffin wax market is expected to reach USD 7.27 billion by 2025. Increasing demand for paraffin waxes in flexible packaging, candle manufacturing, rubber, and cosmetics is expected to aid in market expansion over the next nine years. Rising consumption of these products as a rheology modifier, electrical insulator, friction reducer, plasticizer, and flame retardant is expected to increase market size over the forecast period.

Global Paraffin Wax Market and price assessment

The US paraffin wax marketplace is flat entering 2017 as source/demand fundamentals are widely balanced amid small expectation that the problem will probably soon change.

An integral factor is that the wax can be an instant by-product of the solvent neutral procedure for base oil production. This production route is relevant to the Group I foundation stocks, with all the base essential oil tiers, Group II and higher, carried out by a hydrocracking path that will not yield wax residues. Consequently, as Group II base oils have grown to be globally dominant, Group I production offers decreased, decreasing paraffin wax result also. The effects of the changes for the broadly opaque paraffin wax market continue steadily to stretch into the market dynamics expected for 2017.

US domestic paraffin wax price were largely unchanged across 2016 regardless of ongoing anticipations that the adjustments in wax production in Beaumont and the Group I actually foundation oil closures in European countries would tighten wax source in both regions.

paraffin wax price in 2017

After petrol increase in March 2017, the price of all grades of petrol raised by 28c a liter, keeping the cost of fuel at a high record. Diesel fuel increased 9.4 cents per liter and paraffin up to 12 cents higher. This will affect candle price after Easter time. Paraffin has become a major oil product with its sub-branches recently. The war of Arab countries also has affected inquiry of paraffin wax for making the candle that used for lightening because of lack of electricity recently.

📞 Phone/WhatsApp: +971 50 819 8323

📧 Email: info@paraffinwaxco.com

🌐 Website: www.paraffinwaxco.com